PROFILE:

COMSHARE, INC.

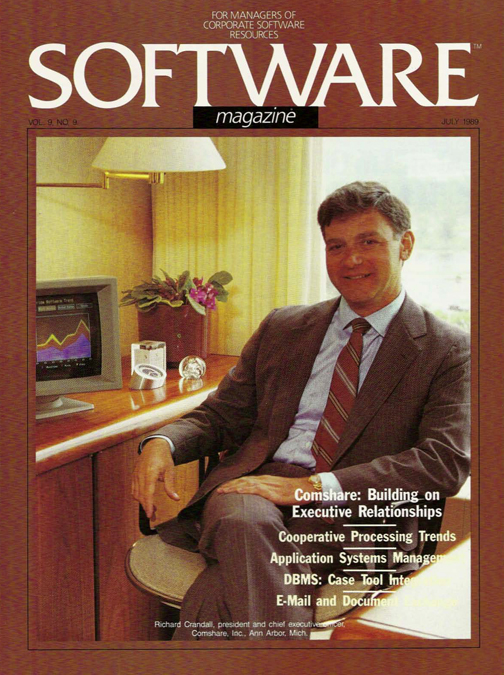

AT HELM OF COMSHARE, CRANDALL EXECUTES PLAN

He turned firm from timesharing, to DSS software, and now to EIS

By Robert Knight

When IBM unveiled its omnibus office automation strategy this past May, the announcement had the effect of endorsing a concept that many of its clients have suspected for years information is more important than data, and information is what executives want, crave and need.

In so doing, IBM also legitimized the newest vehicle for filtering information from data and sending it to the top level of the business organization. The vehicle is an executive information system (EIS), and a full-blown version of it was included in the IBM office package in the form of Commander EIS/SQL from Comshare Inc., Ann Arbor,Mich.

The adjective’ ‘full-blown” is supplied for a reason, IBM announced a two-year renewal of its Cooperative Software Agreement with Comshare, through April 1991 , and announced an EIS product of its own. But the product, Executive Decisions, is seen as a starter kit for executives and not a true competitor of the Comshare product. Not now anyway.

“Executive Decisions provides only status reporting capabilities for modest EIS implementations,” reports William McNee of Gartner Group Inc. in Stamford, Conn. “The real effect of the announcement legitimizes EIS as a mainstream application, because IBM not only endorsed the Comshare product line, it has actively developed and marketed an EIS product of its own, and that has a drag-along effect for all current EIS vendors.”

The winds created by IBM’s fluttering coattails therefore are expected to benefit Comshare, which analysts estimate commands roughly half of the EIS marketplace, as well as its competitors, including Pilot Executive Software of Boston, Execucom Systems Corp. of Austin, Texas, and Information Resources Inc. of Waltham, Mass.

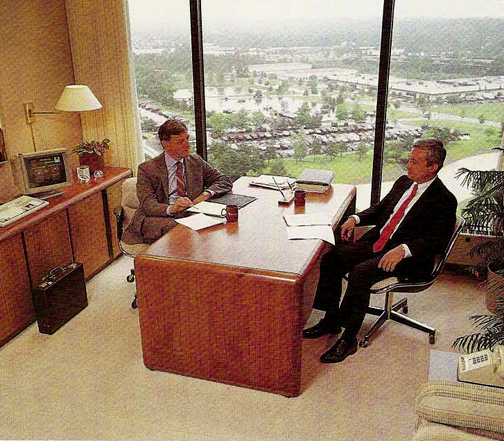

COMMAND’S COMMANDER EIS. from his perch above Ann Arbor, CEO Richard Crandall plots software strategy with Dennis Ganster, vice president for product management. With a Commander ElS station at his desk, Crandall is a user of his product.

Richard Crandall, founder and CEO of Comshare, acknowledged that there might be some confusion about the fact that IBM renewed its marketing agreement for Comshare’s EIS product, while announcing it would release one of its own. But he downplayed the apparent double-dealing.

“It’s not too different from IBM and Microsoft,” he said. “Companies who are too fearful of competition with partners are not going to do very well when they venture forth into partnerships,” he suggested.

Another twist is the relationship between Comshare and Interactive Images, Inc., Woburn, Mass., and Interactive Images and IBM. The Easel product from Interactive is a PC-based graphical user interface that can serve as a front end to IBM mainframe applications without change to the mainframe code. Comshare has used Easel as a tool in its EIS. “Our customers can custom frontend old software with human factors that are consistent with Commander,” Crandall said.

Meanwhile, IBM recently announced it has taken a 10% to 15% equity position in Interactive Images, which makes Interactive a partner of both IBM and Comshare. IBM will market 0S/2 Extended Edition Easel as an IBM program product (under the IBM label).

Crandall said, “IBM’s recent blessing of OS/2 EE Easel furthers our differentiation.” He noted that Comshare can include OS/2 EE Easel with OS/2 EE Commander.

Douglas Kahn, CEO for Interactive, describing the relationships as “curious and interesting,” said, “We’re all interested in how it plays out in the long run. Obviously, there’s a potential for conflict between IBM and Comshare, but IBM has shown a desire to build a relationship that works. They’re working very hard to do both: market Commander EIS and develop Executive Decisions.”

EIS competitor David Friend, chairman of Pilot, said, “The competition is good for everybody. Anybody who comes into the market like IBM is doing, helps us all.”

IBM, of course, has yet to deliver its promised packages. And Comshare has a definite head start not only in installed base, but in R&D investment of over $45 million into Commander to date, according to Crandall.

A GROWING MARKET

All the ElS players are in a position to benefit. from what analysts see as healthy growth in the niche. EIS is expected to attract $89 million in revenues worldwide by the end of 1989, according to Jackson L. Spears, vice president of research at Chicago Corporation, a brokerage and investment firm.

Intemational Data Corp., a market research finn based in Framingham, Mass., estimates those annual revenues will have grown 56% by the end of 1989. Before the IBM announcement, IDC estimated EIS would grow to a $115 million market by 1992. Gartner tacked on an additional $10 million to that prediction.

Comshare announced Commander in 1986, two years after Pilot announced its Command Center product. (Although, Crandall notes that Comshare installed an EIS at Owens-llinois in 1980, and offered the Execuchart product in 1981.)

Cornshare has been in the business of helping users manipulate data since 1966, when it began serving southeast Michigan companies as a timesharing service. Crandall was one of six employees of the University of Michigan’s computer center who started the entrepreneurial venture.

As late as 1982, Comshare derived 98% of its revenues from the timesharing business, and 2% from packaged software. But then the transition to software vendor began. With its System W decision support software, Comshare found a healthy niche.

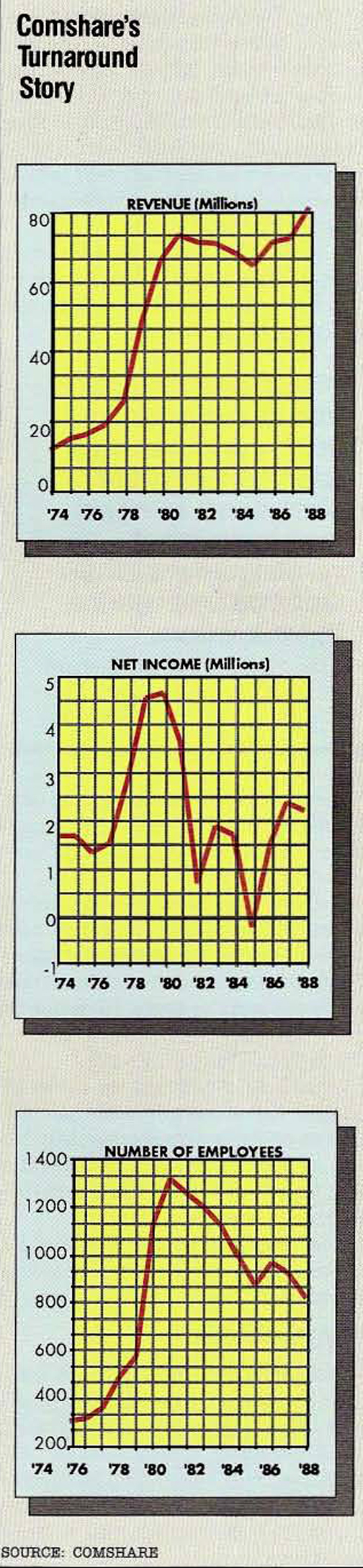

This transformation has brought the company through a significant downsizing. The company peaked at 1,400 employees in 1981; at year-end fiscal 1988, the company had 780 employees. Revenues peaked at about $80 million in 1981, with earnings of about $4 million. Revenues for fiscal 1988 were $78.9 million, with earnings of just over $2 million.

ATTENTION TO DETAIL

One reason Comshare has withstood this transition has been the close attention paid to its marketplace; not just its numbers, but its psychology. A walk through Comshare offices reveals a bold mixture of marble, pre-classic Greek pillars and oriental art. They are offset by clean lines of burgundy and gold that highlight fumishings, floor coverings and ceiling moldings.

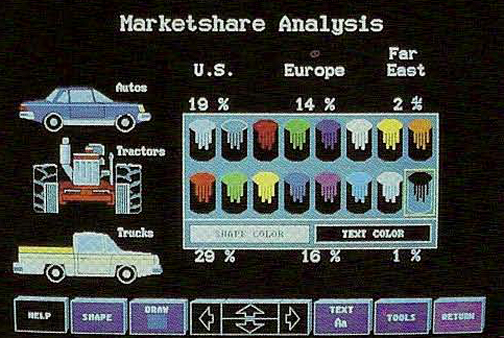

ICONS TELL STORY. The icon driven interface of Commander EIS.

The burgundy and gold, traditionally identified with executives, are repeated in the pages of a product brochure that is as slick as the product it discusses. The marble appears on the cover of the company’s most recent annual report.

It is all by design, according to Crandall, whose hobbies include collecting coin-operated musical instruments, and under water and outdoor photography.

“Nobody’s ever asked me about the interior design before,” he laughs. “But I had some very definite ideas about this; it had to be contemporary with traditional values. And we wanted to avoid a ‘computeristic’ feel.”

Indeed, visiting executives pass glass wall after glass wall enclosing the offices of Comshare’s own executives. And each office displays the sharp, colorful graphics of a working version of Commander EIS. It was, after all, Comshare executives who first tested the product before it was released. Especially Crandall.

“I do the human interface work for Commander, which is a unique role; a CEO executive is specifying what is to be used by other executives,” he says. “Software conceived by one person can be better than committee software, because it takes one person to crash through the doubters on the committee. A committee will never break from the current thinking.”

Dennis Ganster, Comshare’s vice president for product management, said, “We have established advocates for each major user type: for the executive user, for the information provider and for the administrator. Rick is our advocate for executives, because he is one of them.”

Product managers Keith Kremer and Steve Coatney act as advocates for client administrators and the information provider, respectively, “I report up to Rick, but as an advocate, he plays the role of product manager,” Ganster said.

Ganster’s prime function is to establish product priorities which Mary Danforth, Comshare’s vice president for product development, translates into the codes and tools needed to implement the product or new release.

FIVE MODULES FOR EXECS

Crandall says, to an executive, an EIS is a collection of applications that mimics the daily information activities of the executive. These activities determined which Commander modules would be developed.

Five emerged: Briefing Book, a dynamic collection of reports from sources throughout the organization; Newswire, which tracks news items and stock prices via Dow Jones News/Retrieval service; Execu-View, a non-technical method of windowing through corporate information; Redi-Mail, a recently announced front end to IBM’s Profs electronic mail system and IBM’s new OfficeVision; and Reminder, an electronic tickler file.

Briefing Book especially has provided a ready conduit for trickle-up information for Comshare clients, Crandall says. Under the old system, subordinates painstakingly pieced together periodic manual reports to give top management a detailed view of what was going on in their organization.

“The subordinates were trying to guess what the executive wanted, which may or may not have been what the executive did want. And by the time it got to the executive, the information was old anyway,” Crandall said.

ElS helped executives overcome that problem at General Electric Aerospace in Philadelphia. Larry Runge, project manager for the services systems development division of GE Capital, a subsidiary in Stamford, Conn., was responsible for introducing a Commander EIS system at GE Aerospace.

“Managers were amazed at the types of information they got and the meaningful way it could be presented in an EIS,” Runge says. “They didn’t have to wait for the information to come through the ranks; the executives could see it as soon as it was available. In a competitive business environment that makes a big difference.”

A Boston financial services company sought to track the performance of 3,600 life insurance agents in 90 regional U.S. offices.

“We now have a better understanding of what conditions are influencing our sales operations, and what is causing general agents to make certain decisions,” said Vince Ficcaglia, vice president for insurance and personal financial services at the New England (formerly New England Mutual).

The objective of getting senior executives comfortable accessing information on a computer was also met. “Commander gave them software with a mouse, icons and no programming. The impact on our executives has been just phenomenal,” Ficcaglia said.

ON BOARD WITH SAA EARLY

Soon after IBM announced its Systems Application Architecture (SAA) direction two years ago, Comshare had a commitment to be SAA-compliant. The compliance has cost the company $5.5 million in development costs so far, Crandall said. Comshare was one of 14 independent software vendors to participate in IBM’s OfficeVision announcements in May.

(Commander EIS runs on IBM mainframes under MVS/TSO and VM/CMS, and on microcomputers and recently, laptops-under PCDOS and OS/2, as well as on DEC VAX under VMS.)

Although the IBM relationship is key, Crandall points to a burgeoning Commander EIS network outside of IBM’s influence.

For example, Comshare’s relationship with Dow Jones is growing. They are working together to expand Dow Jones news offerings by allowing executives to “drill down” into news stories using an artificial intelligence-based function.

It is also working to establish a company tracking service that would allow executives to gain access to a dynamic pool of Dow Jones databases, via touch screen, to get immediate information on competitors, customers or other vendors.

Management Science America in Atlanta is developing a value-added EIS with Commander as its base. John Imlay, MSA’s chief executive officer, says he is one of Crandall’s biggest fans.

“I’ve known Rick Crandall for 20 years and he’s one of the brightest executives in the software business—I knew him when he wasn’t in the software business, when he was still in timesharing,” Imlay says.

“He had the guts to find an application area that was state-of-the art, and he had the where with all to go into the software business, because he knew that timesharing was dying. He laid out a strategic plan that focused on developing EIS and then he executed it beautifully.

“The interesting thing about Comshare is that when timesharing was its main service, it knew what every customer was doing every moment, and that idea of customer service has carried over into Comshare’s software arena. Its customer base is extremely satisfied and well attended to,” Imlay said.

Comshare’s Centralized Product Support System (CPSS) produces data from customer feedback via the company’s Help Desk.

“The major challenge for a software company in the next five years is to not get spread too thin fighting platform wars. I don’t just mean hardware and operating systems but also databases, languages and human interfaces,”

Richard Crandall

Presldent & CEO

Comshare

Comshare sponsors an annual user group meeting, and convenes an advisory board of the 12 largest Commander clients.

Crandall says he is sensitive about claiming too much credit for Comshare’s success, but those who know him consider Crandall and Comshare to be one and the same. He is one of the company’s founders, its visionary and its driving force.

He is also a charter member of Adapso, for which he chairs the committee on long-range planning. He was Adapso’s president in 1978, the first year that the organization formalized its strategic planning.

It is from this perspective that he addresses what is happening to the industry.

RESPOND TO USERS

“The major challenge for a software company in the next five years is to not get spread too thin fighting platform wars,” Crandall says. “By platform I don’t just mean hardware and operating systems but also databases, languages and human interfaces.

“It’s more important for a company like ours to respond to what our users tell us they want, which is for vendors to concentrate on meeting their applications needs, and less on technical developments to accommodate myriad platforms. That’s why we have adopted SAA standards. SAA is real. Sometimes we have to step around the potholes, but those vendors who are ignoring it are in trouble,” he says.

Trouble is something Comshare is not in, according to Gartner’s McNee. “Comshare appears well- positioned for sustained growth in the 1990s. With its mature and trained sales distribution channel in place, supplemented by the marketing muscle of IBM and MSA, we see little reason why it cannot become one of the next $100 million players.”

McNee does wonder what might happen if IBM should enhance its Executive Decisions product to make it more than a “starter kit,” but he says he is confident of Comshare’s ability to stay ahead of the market.

Spears from Chicago Corporation expresses similar enthusiasm for Comshare’s immediate future. “They’ve identified their niche and clearly they’ve done a hell of a job filling it. From the user’s point of view, that’s good news.

“But if the market gets bigger and more competitive, how is Comshare going to utilize its momentum? Eventually, they’re going to have to do something different-buy other companies, maybe, or broaden their productline,” Spears said.

“I’d like to see them do more in marketing information services. They’ve got their DSS product, System W, which is aimed primarily at financials; why not also marketing? It seems a logical extension of their experience in both DSS and EIS,” he added.

Whichever direction Comshare goes, Crandall wants to make sure nobody looks at his existing products as cure-aIls.

“An EIS won’t patch up all executive woes,” Crandall says. “It won’t help someone who is just trying to cover his ass. It will help someone who is trying to do a good job.”.

Reprinted from SOFTWARE MAGAZINE. JULY 1989. Copyright, 1989, Sentry Publishing Company. Inc., Westborough, MA 01581