Historical Excerpts From:

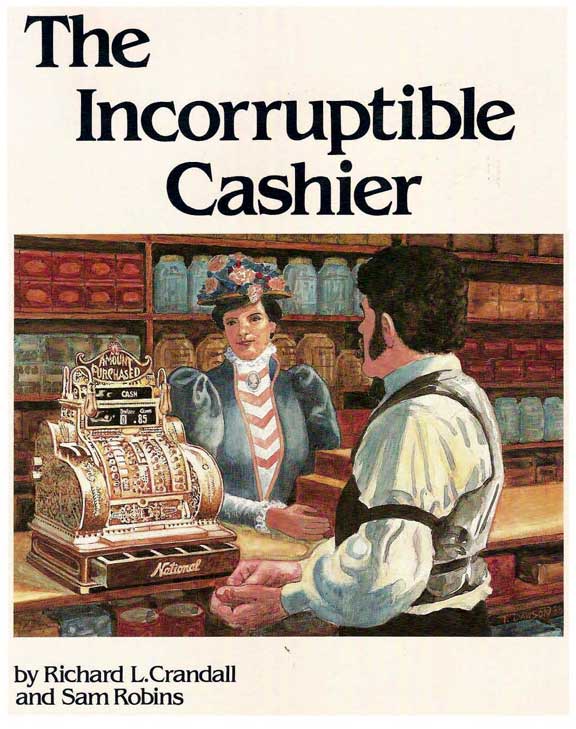

The Incorruptible Cashier

Excerpts from two-volume reference books on the formation of the cash register industry in 1878 – the machine that transformed the retail industry – and became the predecessor to the formation of the computer and business equipment industry.

These books, Vol I (182 pages) and Vol II (390 pages), were published 1988 and 1990.

The Cash Register – A Place in History

We’re not so clever. It has taken us more than 100 years to implement the business automation that originally was made possible by the invention of the cash register in the 1870’s. Still today in many retail establishments, bells ring, drawers pop open, indicators jump up with amounts paid and counters record cumulative transaction amounts.

You can find all these functions on the NCR Model 35 of 1892…

Finally a change occurred during the 1980’s: the “telecommunications networked optical scanning electronic point-of-sale terminal” a fancy way of describing the new “register” showing up in supermarkets and other high-volume retail stores. Such devices will finally antiquate their predecessor cash registers.

The transition has been far easier than in the 1880’s when a hoard of entrepreneurs sprang up around the country, each with his own gimmick to help the store owner reduce pilferage from the open cash drawer.

The first cash registers were heavily promoted as theft deterrents to be sure. But they were also instruments of a new analytical approach to business which resulted in a systematized use of information to produce profits. There were accounting and executive information features in the turn-of-the-century cash register that do not exist in many machines today. How many company executives today know daily sales by product category and transaction type? But now the register is becoming part of a broader business system. They are now considered sources of input data and have moved into the realm of data processing “decision support” and “executive information systems….”

The cash register was a combination of a security system, accounting machine and a management information system. All this was implemented with moving mechanical parts, gears, cams and levers and housed in grand cases. If that wasn’t enough function, the cash register also expanded beyond its namesake (the handling of cash) to the extension of credit. Its special credit function keys helped the store owner keep tabs on amounts due and amounts paid.

Thus the cash register was the mechanizing force behind the profitable use of information about cash and credit. Ironically, the electronic cash management systems of today will eliminate cash with its automatic connections to bank accounts. This will truly make the cash register 100% obsolete….

Who Was First?

James Ritty of Dayton, Ohio is generally credited with inventing the cash register in 1878. Our research indicates that while there were cash register inventions patented before the Ritty register, none appear to have succeeded commercially. Unless some new revelation is uncovered in the future, it can be said that James Ritty, before the National Cash Register Company we know today was established, invented a device and received associated patents that led to early domination of an industry that later broadened into the massive office equipment industry of today..

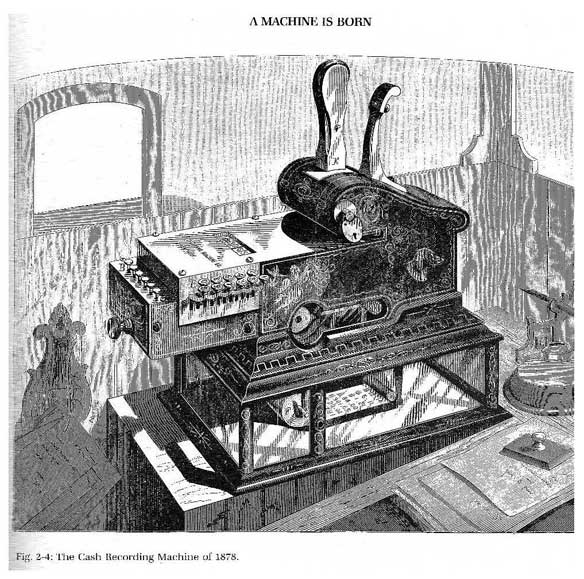

As is the case with most attempts to ascertain who was the first at anything, the cash register picture is unclear. For example, the Cash Recording Machine Company of New York City had its Cash Recording Machine on the market in early 1878 for a price of $75. One such example is known to exist today.

Of course if one loosens the definition of cash register to “any device which can record money transactions and cumulate them” we presumably need to go all the way back to the abacus which is estimated to have been in use in China thousands of years B.C.

Today you can still find the abacus in use in some Chinese retail establishments – an amazing product with a life span of some 4500 years. The abacus is easy to learn, can store a result (if no one upsets the beads) and can even be used as a “total adder” to cumulate transactions values during the course of a day.

Then there was a Frenchman by the name of Charles Xavier Thomas who, in 1820, invented the Arithmometer, the world’s first commercially successful calculating machine. It performed mechanically the four classic functions of addition, subtraction, multiplication and division. Despite its features, neither it nor any derivative from it, ever saw use as a money recorder for business.

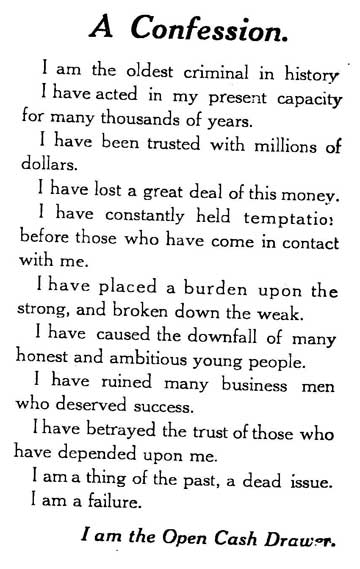

The Cash Till

It is difficult to imagine a retail store without a cash register or point-of-sale device; yet before 1879 merchants had no such equipment. They never actually knew if they were operating at a profit or a loss. While store owners may have gone to great lengths to instruct clerks to record all sales transactions to a “Day Book,” rarely was this done consistently. Negligence, illiteracy, laziness and dishonesty made proper accounting an impossibility.

Temptations to pocket money were overwhelming since cash was usually in open cash boxes or even in clerks’ pockets as a normal matter of course. The proprietor could not determine whether he was suffering pilferage since he had no accurate account of actual cash taken in, the number of transactions or which items sold in a day.

Retail store owners found themselves living on cash flow produced from inventory liquidated at sales prices which could not support continued operations. The only way a firm’s financial condition could be determined was by taking physical inventory, a time-consuming and arduous procedure not often done.

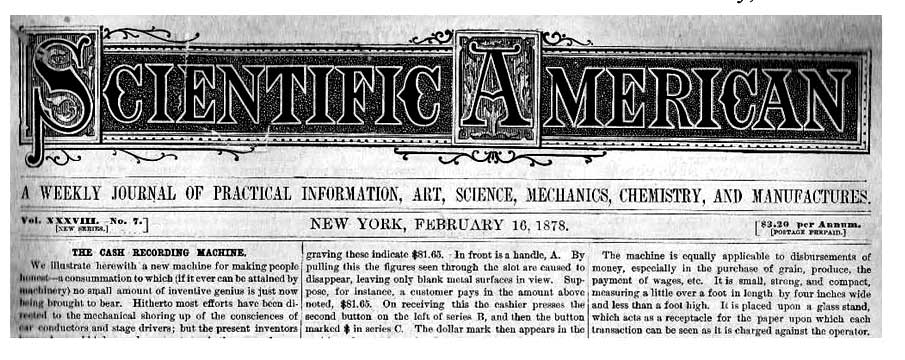

The Cash Recording Machine

There are a number of stories of how the idea of a cash register came into being. They all stem from similar concerns. A Scientific American article from February, 1878 featured

“The Cash Recording Machine,” billing the invention as:

“… a new machine for making people honest – a consummation to which (if ever it can be attained by machinery) no small amount of inventive genius is just now being brought to bear.”

“Hitherto most efforts have been directed to the mechanical shoring up of the consciences of the conductors and stage drivers, but the present inventors have advanced higher and propose to apply the same salutary influence to the moral sense of every class of employee within whose duties the handling and disbursing of cash is included.

“It must have occurred to any one who has noticed the Babel of confusion which exists in any retail dry goods store, for example, when crowded with shoppers, and when a constant stream of cash boys circulates between clerks and cashiers, that scarcely any system of checks and records depending on the memory and fidelity of the employee can exist which does not leave loopholes for fraud. We are not prepared to assert that the present machine will at once be a system in which it is impossible to swindle, because it is a lamentable fact that there is nearly as much ingenuity enlisted in the service of sin as in that of virtue, and somebody may discover how to “beat” even the most thoughtfully contrived mechanism, but the new “cash recorder” certainly offers a simple mode of keeping accurate records. We fail to see where the chance to defraud it exists.”

The certainty of these statements about infallibility arises from the ingenious idea of involving the customer in thee audit process. In the words of the patent;

“… this is accomplished by registering on a paper strip inside the machine the amount of any transaction, and printing or stamping the same amount simultaneously upon the account, bill or ticket inserted for that purpose…”

By printing the transaction amount on a check receipt for the customer, inaccuracies became highly visible. By printing the same amount on an inaccessible audit tape locked within the machine, the proprietor could add the numbers at the end of the day and compare the total with the contents of the cash box. The store keeper might further motivate a customer audit by posting a money-back reward to anyone not receiving a correct receipt.

James Ritty

Another inventive spirit with similar concerns was James Ritty, a saloon owner in Dayton, Ohio. Ritty’s business was booming in 1878, but there were no profits. Ritty came to despair about suspicions that his bartenders had their hands in the till. So, to relieve his tensions, he booked a vacation steamer trip to Europe.

The story goes that Ritty, having been trained originally as a mechanic, became interested in the machinery of the ship. He paid particular attention to the counting mechanism that recorded the revolutions of the ship’s propeller shaft. With thoughts still fixed on the losses in his saloon, he had an inspiration: why couldn’t a store’s sales be recorded in mechanical fashion similar to the shop’s propeller revolutions?

The inspiration proved an instant cure to his personal distress: he even booked immediate return passage from Europe without staying there a single day! Back in Dayton, Ritty excitedly confided his idea to his brother John, a skilled mechanic. Together they began work on their own home-grown original version of a cash register.

Inventing things on the spur of the moment was a common practice of the period. It was 1878, one year within an extraordinary decade of great mechanical invention.

In what would later be seen as a fateful omen for a much later confrontation, a now-famous inventor named Hollerith was in 1886 trying out punched cards with tabulating machines in the Baltimore, Maryland Department of Health. His effort would later evolve into the IBM Corporation. All of these “can-do” technical inventions seem to have derived from high expectation about the limitless future coupled with a rapidly growing understanding of mechanics. Add to these an environment of no government regulation, no labor unions or other barriers to productivity and the result is the vast array of mechanical predecessors to nearly all of today’s electronic and mechanical marvels.

When the Ritty brothers invented their cash register, they did so within the same tradition of many of the other inventors of the day. Rather than pursuing some long-range plan with theoretical Return-on-Investment forecasts, they responded to a clearly focused goal to solve a clearly defined problem with a quick prototype. When the prototype showed faults, they added to the invention to fix the problem.

They dubbed their machine The Incorruptible Cashier – an apt name, capturing the primary benefit – solving the cash-drawer pilferage problem.

The National Cash Register Company

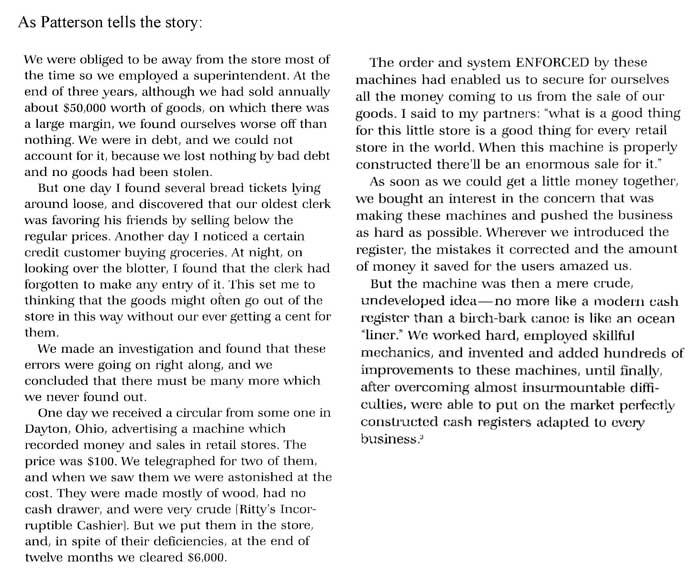

During the earliest days of the Rittys’ activity, the rather ambitious name of National Cash Register Company was chosen for the somewhat unassuming familial partnership. The business offices consisted of a single room over James Ritty’s saloon in Dayton. During the ensuing several years their cash register business was sold twice, ending up in the hands of another businessman in Coalton, Ohio: John Patterson. He owned a grocery and general store which sold goods to miners.

Patterson was a marketer and a ruthless competitor. In the early years of NCR a fortune was spent on advertising and direct mail to educate the public and to establish national’s name as a well-known entity.

An ad in The American Store Keeper of Chicago in August of 1886, said:

What is a Cash Register?

“It is an automatic cashier which records mechanically every sale made in a store. It never tires. It never does one things while thinking about another, and never makes a mistake. It is a mathematical prodigy in brass and steel, all of whose computations are infallibly correct. It is a machine which will save the money you make and thus pay for itself over and over again.”

Cash registers became an industry. In the last two decades of the 20th century there was a frenzy of entrepreneurial and competitive activity with 84 companies being formed. By 1915 over 350 companies had put competitive machines on the market. An industry was in formation, lawsuits and all.

Perspectives on John H. Patterson

John Patterson merits some specific attention in that it was his innovative ideas and methods that succeeded in establishing NCR as the dominant force in the industry. Patterson was idolized within his company and he became a legend. He was feared, respected, understood and misunderstood – typical of a leader with vision and unstoppable drive to establish his will above others.

Those who found themselves on his good side were accepted, cared for, amply compensated and made comfortable. Those who crossed him were eliminated – employees were fired, competitors were run out of business.

Patterson is generally credited with inventing the steps associated with today’s approach towards the “sales cycle” used by most professional sales forces. It was likely Patterson was the first to think of selling in process terms. Today, the famous sales forces of the high tech industries (IBM, Xerox, Diebold and others) all use derivatives of his methods.

Parts of Patterson’s methods were the continual barrage of direct mail and advertising. Prospects received so much mail from NCR that one response in May, 1886 was a return of a mailer with a terse handwritten remark: “Let up, we never done you any harm.”

He was ruthless about terminating people that didn’t fit into his mold of the ideal employee. In one account of a firing, it went like this:

On one occasion he called in a foreman to get a report on the work in his department. The man said: ‘I am glad to report that we are 100% efficient, the men are loyal and the best we can get. Our product is perfect as can be made.’

‘Then you are perfectly satisfied?’ said Patterson.

‘Yes sir, I am’

‘All right.” retorted Patterson. ‘You are fired.’

In the John Patterson code, no one should be completely satisfied.

Selling Through the Eye

At the NCR sales convention of 1886 Patterson was trying to illustrate a point with his hands when it suddenly struck him that he could make his point more clearly in school fashion with a blackboard. He sent out for a blackboard and thereafter he never held a meeting without a blackboard on which to draw diagrams. Out of this grew the whole theory of teaching through the eye.

“Business is only a form of teaching.” He would say. “You teach others to cooperate with you … to succeed in business it is necessary to make the other man see things as you see them… One of the many advantages of teaching through the eye is its exactness… I have often heard a speaker ask, ‘Do you see my point?’ He wants to know if the hearer actually has the point in eye as well as in mind, that he understands it well enough to make a mental picture. Instead of asking if the point is seen, why not draw the point so that it cannot help being seen?

I have found that words, whether written or spoken, without some kind of drawing on which to center attention, are not effective.

The very first advertising that we put out after starting the NCR taught me this lesson. I had some five thousand circulars printed describing the new machine and what it would do. I told what it had one for me and how it could prevent business leaks. It did not have a picture of a register. We hired two extra men to answer inquiries. We waited and we might be waiting still, for we did not get a single inquiry.

Very few people understand words … ‘Food’ to a baby means milk … but ‘food’ to a chef calls up thousands of delicacies… as something to prepare rather than something for himself to eat.

The ideal presentation of a subject is one in which every sub-division is pictured and the words are used only to connect them….

I used to employ an artist to make sketches of things that were not being done right. Then the sketches were made into drawings and I called the men together and showed them exactly what they were doing ….”

Another story, this one is about unwittingly selling the wrong thing “through the eye.” Patterson was walking along store fronts and saw one with a shoe display brilliantly lit up with many light bulbs, which were unusual in the pre-1900’s period. He walked into the shop and asked the proprietor “I’d like to purchase a dozen light bulbs.” The proprietor responded that he doesn’t sell light bulbs. Patterson asked: “what do you sell?”

“Shoes” was the response. “You could have fooled me from that display!” … always the teacher.

Competition Patterson-Style

Patterson was opposed to free enterprise and open competition – the very environment that fostered his own beginnings. He believed he had a right to all of the cash register business. He had his own sense of ethics that was of the school that it doesn’t matter how you get there – it’s the end result that counts.

Patterson’s style of getting things done is surely part of the corporate behavior pattern in the early 1900’s that gave rise to unions for the protection of employees and antitrust laws for the protection of free and fair competition.

One recollection from a vice president and general manager of National from 1903 to 1907 is just one example of how ferocious a competitor was Patterson:

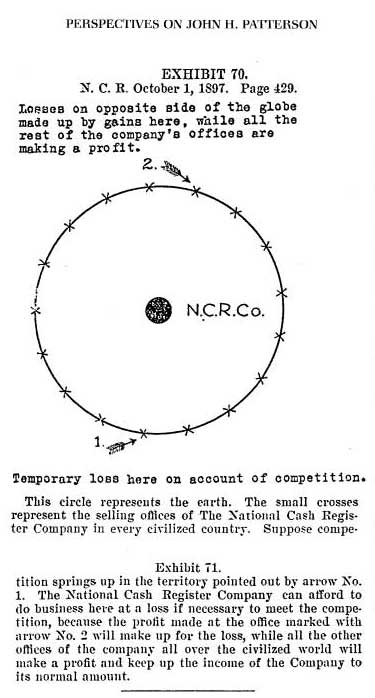

“In the discussion of competition at the meetings of the district agents, I remember John Patterson used a circle on the blackboard as an illustration. I have heard him make the illustration when he talked with competitors, that our money came from all over the world from the sale of machines and this money would naturally come in from all over the world but only one section was affected by competition.”

He was talking about a classic case of cross subsidization illustrated in an exhibit to a lawsuit as shown.

“I remember his dog story. It was: If you are going to kill a dog, it would be much kinder to hit him on the head instead of beginning with his tail and cutting off an inch or two at a time.”

Competition and the 1912 Federal Antitrust Lawsuit

Much has been written about the turn-of-the-century competitive practices of the companies that grew dominant in their industries (Standard Oil, Western Union). NCR was a prototypical example. There is irony in the fact that the 2100 pages that document the U.S. federal antitrust lawsuit against NCR, tried in 1911 – 1912, did wonders in preserving valuable historical information about NCR, the cash register industry and other specific business equipment companies. Just a few of the court’s findings are included here:

- The inducing, hiring and bribing of employees of said competitors of said National Cash Register Company deceitfully and wrongfully to disclose … the secrets of the business of the concerns by which they were respectfully employed …

- The using of influence of said National Cash Register Company … and the making of unwarranted and false statements to banking and other institutions, to injure the credit of said competitors …

- … inducing through such false, libelous and unwarranted statements … (to surrender competitive cash registers of that company in exchange for National Cash Register Company registers) upon such basis that those persons would lose nothing… actually exhibiting such competitive cash registers, so obtained in exchange, in the windows of stores … using placards in come cases with the work “Junk” printed thereon, in other cases with the words “For Sale at Thirty Cents on the Dollar” printed thereon … at a price in all cases much lower than the regular price of such competitive cash register, in some cases offered for sale … was one manufactured by said National Cash Register Company, solely as a so-called “knocker” in such close similitude to the competitive cash register … and by instructing sales agents of said National Cash Register Company … secretly to weaken and injure the interior mechanisms …

- The organizing of cash-register manufacturing.. and sales concerns and the maintaining of them, ostensibly as competitors of said National Cash Register Company, but in fact as convenient instruments for use in gaining the confidence and obtaining the secrets of said real competitors … and the making of such use (to secure ownership and control) of said competitors …

- By applying … for letters patent in come cases upon the cash registers of said competitors and in other cases upon improvements upon such competitive cash registers, and this merely for the purpose of harassing such competitors ..

To elaborate more fully on the technique stated of “weakening” a competitor’s machine, one story goes like this: Competitive machines taken in by NCR would go through a refurbishment. The register would be shined up to look good, but critical brass or steel gears would be replaced with weaker fiber gears. The registers were then sold via Watson’s second hand stores (a disguised National front) at much lower prices that the nearby competitive store front. Yes, that is THE Watson, see further below.

The effect was a double blow. The low-priced sales knocked out the adjacent competitive register shops and then the doctored registers would fail within months, thereby causing a bad reputation for the competitor. Of course a National representative would immediately appear on the scene to give a generous trade-in on a new NCR. The customer, while spending more money than desired, was relieved that National bailed them out of a bad purchase.

NCR often defended its monopoly position in the market despite many documents showing the deleterious effects:

“I presume that there are about fourteen or fifteen different styles of registers in an embryo state, waiting to come upon the market. When they appear, we will jump onto them and knock them out.” Jno Patterson

“We have four experimental departments working on patents, some of which we may not put on the market for two or three years to come. We don’t believe in making improvements faster than competitors force us to.” Jno Patterson

“The more opposition registers put on the market, the more we will knock them out. Whenever I hear of a new machine, it don’t scare me, because I know that we are able to duplicate it – to put a knocker on it – a better register at a less price and that way to discourage and kill it.” F. J Patterson, May 1, 1892

“… if we had severe competition we would have to build a machine to meet that competition. We called it a National machine. It was the same as the new machine in shape and everything else, the same key arrangement and operated the same way.”

— NCR Competition Department

|

|

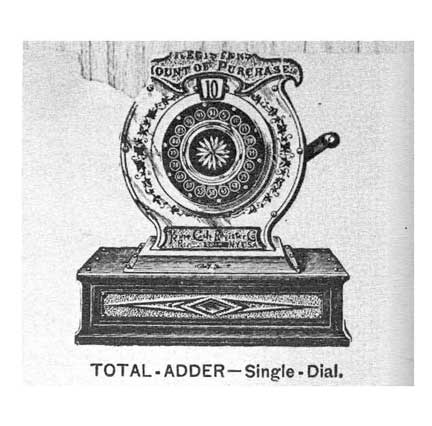

Kruse Cash Register Company “Dial’ register, attractive and innovative. It was the first “total adder: technology that added all transaction values accumulating during a day’s sales for end-of-day cash reconciliation. |

NCR’s copy of the Kruse machine, dressed up with a brass cherub and moon and changed drawer-front with National’s logo. |

Here is an amusing photo of NCR’s Chairman in 1986, Charles Exley, Jr. published in a May 5, 1986 Business Week article on NCR. While Exley told the photographer that this register was never put on the market, he may not have known the real reason why.

This register was created by NCR in 1892 as a knocker to intimidate the Kruse Cash Register Co. into selling out! Oops.

Kruse actually sold out to the Lamson Cash Register Company and subsequently, using similar techniques, NCR bought Lamson in March, 1893.

Thomas Watson Sr.: from NCR to IBM

The reference to Watson is indeed the now famous Tom Watson Sr., founding CEO of IBM. Thomas Watson Sr. joined NCR as a salesman in Buffalo, New York in October of 1895. He was to become a protégé of Patterson, only to leave NCR in favor of an even more impressive task: the making of IBM.

While at NCR, in 1903 he was selected to head a new secret NCR subsidiary, the purpose of which was to gain control of the second-hand cash register industry. The Watson Cash Register and Second Hand Exchange had as its purposes to buy, secretly, the second hand stores for National – especially the ones adjacent to competitors’ store fronts. He then used NCR’s vast stock of traded-in competitor machines that were “weakened” to create havoc among targeted competitors. He would undercut the adjacent store no matter how low they went until he drove them to selling their business or going bankrupt. At times, Watson would acquire the competitive company and the target never knew they were actually selling to NCR until it was too late.

In 1906 NCR repurchased all the Watson stores, their job apparently having been completed. NCR rose to a 95% market share!

Watson became enormously popular with the NCR sales force and Patterson reportedly grew envious. Watson’s behavior became increasingly confident and began to oppose some of Patterson’s policies. In literally a fiery end, Patterson “fired” Watson (upon returning from a trip to Europe, reportedly Watson found his desk burning out on the lawn in front of headquarters). At age 40 he left NCR reportedly saying:

“I’ve helped build all but one of those NCR buildings. Now, I am going to build a business bigger than John H. Patterson has.” And that he did.

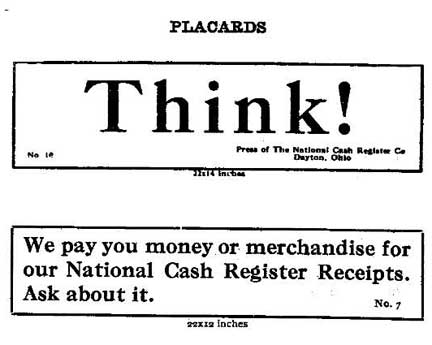

Here is the famous IBM motto “THINK” but this is a page from the NCR 1915 Trade-in Guide! “THINK” was coined at NCR in the winter of 1911 by Thomas Watson according to Frederick Fuller, My Half Century as an Inventor. THINK signs went up everywhere at NCR and eventually were even sold to the public in placard form. Watson often said “I didn’t think” has cost the world $ millions.”

Watson found just what he wanted in the newly formed Computer-Tabulating-Recording Co. the result of merging Herman Hollerith’s Tabulating Machine Company, the International Time Recording Company, the Dayton Scale Co. and Bundy Manufacturing Co. Watson’s first products were an adding tabulator, a sorter and a card punch. His training at NCR undoubtedly put him in good stead to make Computing-Tabulating-Recording Co. highly successful. He renamed the company IBM in the 1920’s which did indeed grow to be much larger than NCR.

Many more stories, hundreds of pages of cash register collector information and hundreds of photos of rare and common machines can be found in the two volumes of the Incorruptible Cashier: the Formation of an Industry, now out of print but occasionally available in the collectible and used book markets.

Rick Crandall

January, 2010